tax abatement definition for dummies

Penalty abatement is a federal relief program designed to help those whove made a mistake and have incurred penalties. E u l B n e e r G ADVE.

A misconception of Tax Abatement is that this financial incentive is a tax savings.

. For example if one receives a tax credit for purchasing a house one receives tax abatement. Definition of tax abatement. Home abatement definition tax wallpaper.

If the IRS has assessed a penalty against you because. For capital gains tax purposes there is a definition in TCGA92S64 2. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate.

10 pts Let f n 13 23 33. Home definition dummies for tax. Tax Abatement is an annual.

Tax abatement definition for dummies Friday March 18 2022 Edit. An abatement cost is a cost borne by firms when they are required to remove andor reduce undesirable nuisances or negative byproducts created during production. An amount by which a tax is reduced Learn More About tax abatement Share tax abatement Dictionary Entries Near tax abatement taxa tax abatement.

Money saved by reduced business taxes can be invested in other parts of the community. The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax. The term commonly refers to tax incentives that.

Two tax pros offer some insights into how the IRSs penalty-abatement program works and how you may be able to get out of a tax penalty or even get a refund for one you already paid. This encourages new construction or rehabilitation of a property. We would like to show you a.

What Is A Tax Abatement Tax Abatement How Does It Help You. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Property tax abatements exempt all or part of an improvement for a set number of years.

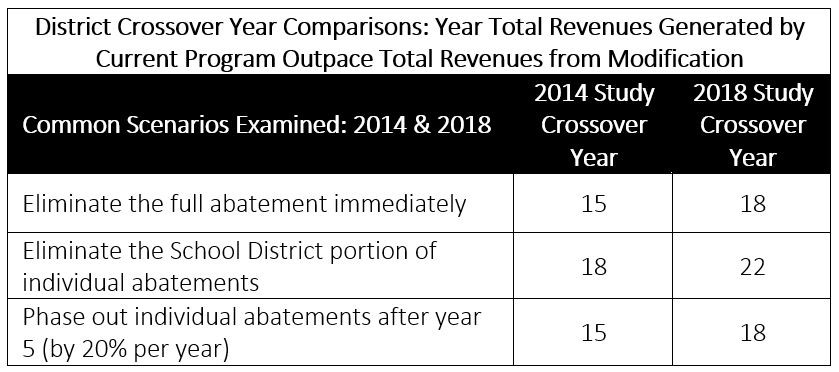

Tax abatement analysis fiscal and economic are complex and rely on existing relationships to measure change. Though the basic concept of TIF is straightforwardto allow local. Tax increment financing TIF is a financial tool used by local governments to fund economic development.

Tax Abatement is an Assessed Valuation Deduction First. When discussing impact analysis both fiscal and economic it is important. A reduction of taxes for a certain period or in exchange for conducting a certain task.

What Is The 421g Tax Abatement In Nyc Hauseit. Tax abatement definition for dummies Wednesday March 16 2022 Edit. January 26 2018 1 min read In broad terms an abatement is any reduction of an individual or corporations tax liability.

Who Receives a Tax Abatement. What Does Tax Abatement Mean. Community may deteriorate and ultimately hurt property owners.

MCQ Tabag Reviewer QUIZZER. A tax abatement is when a taxpayers tax bill or tax liability is reduced or even brought to zero for a certain period of time and depending on various eligibility factors. Tax Abatement Definition.

Tax Abatements Alabama Department Of Revenue

Palacios Economic Development Corporation Pedc

Tax Abatement Exemption Applications

City Releases Study Of 10 Year Property Tax Abatement Department Of Revenue City Of Philadelphia

Philly S 10 Year Tax Abatement Philadelphia Home Collective

Property Tax Abatements How Do They Work

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Gasb 77 Tax Abatement Disclosures Ppt Download

What Is A Tax Abatement Smartasset

What Is Tax Abatement A Guide For Business Operators

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Philadelphia Tax Abatement 2021 Homebuyer S Guide Prevu

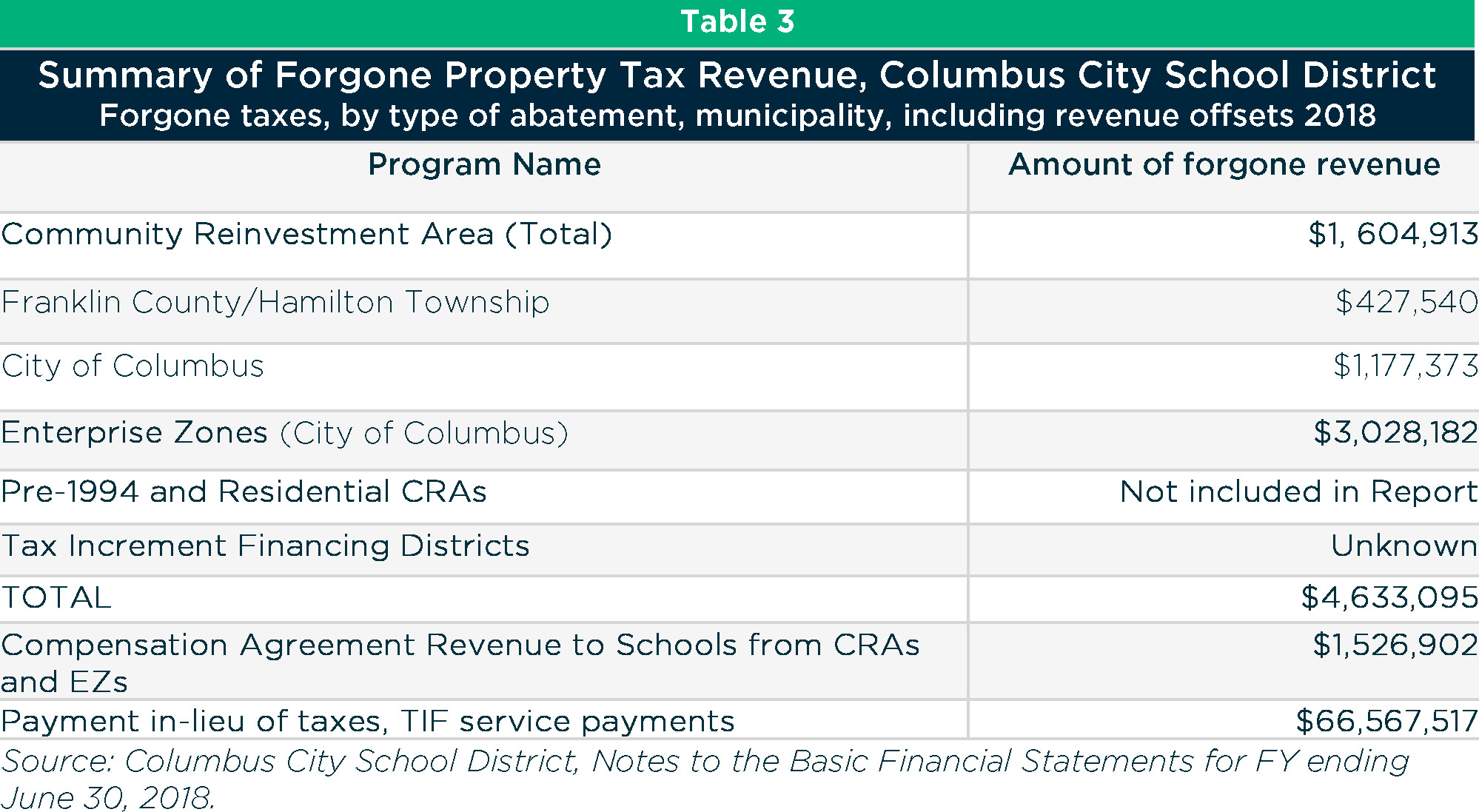

Columbus Property Tax Abatements Transparency And Accountability To Schools And Community

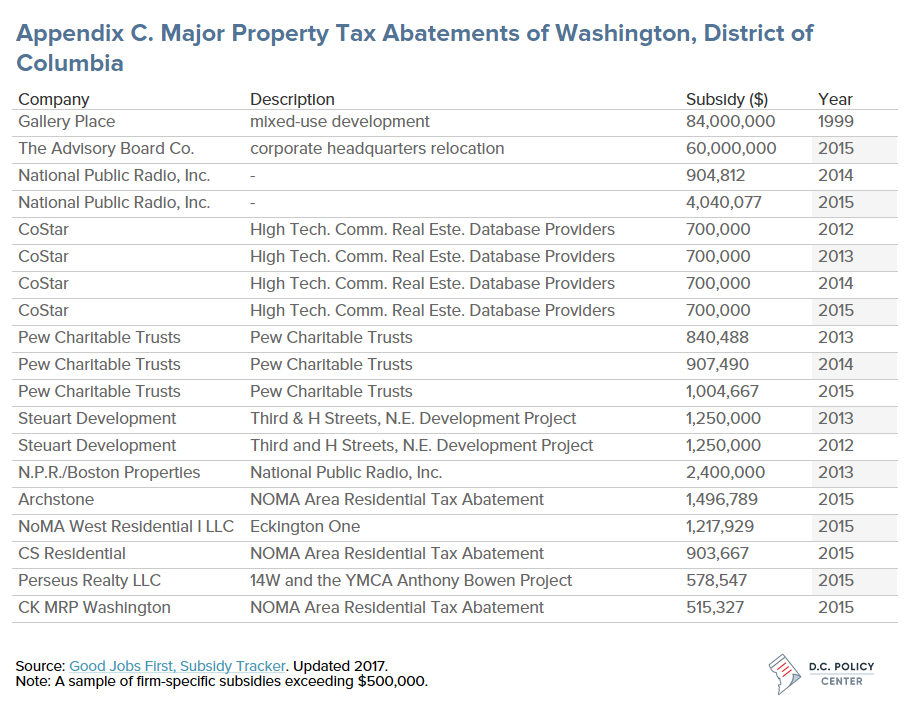

The District S Tax Incentive Strategy Is Unique D C Policy Center

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo