st louis county sales tax rate 2019

State Muni Services. St louis county sales tax 2020.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Louis Sales Tax is collected by the merchant on all qualifying sales made within St.

. Statewide salesuse tax rates for the period beginning October 2019. Sales can be paid for in full on the day of the sale or the purchaser may enter into a contract with the county for a period not exceeding 10 years. To review the rules in Missouri visit our state-by-state guide.

The down payment is 10 of the purchase price or 500 whichever is greater. The sales tax jurisdiction name is St. The Assessor is also responsible for.

County-wide reassessments take place every two years in odd numbered years. The current annual interest rate as. 2019 Property Tax Rates Results Sections 13707353 and 13707354 RSMoprovide that a voluntary reduction taken in a non- reassessment year even numbered year results in a reduced tax rate ceiling during the following reassessment year odd numbered year.

2020 rates included for use while preparing your income tax deduction. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The St Louis County sales tax rate is.

The 2018 United States Supreme Court decision in South Dakota v. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Statewide salesuse tax rates for the period beginning July 2019.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Statewide salesuse tax rates for the period beginning April 2019. What is the sales tax rate in Saint Louis Missouri.

Report for the fiscal year ending december 31 2019. You pay tax on the sale price of the unit less any trade-in or rebate. Statewide salesuse tax rates for the period beginning August 2019.

The latest sales tax rate for Ballwin MO. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax. The St Louis County Sales Tax is 2263.

Subtract these values if any from the sale price of the unit and. Has impacted many state nexus laws and sales tax collection requirements. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. These provisions also allow taxing authorities that. The minimum combined 2022 sales tax rate for Saint Louis Missouri is.

While property values listed on the assessment rolls are used to calculate annual property taxes the Assessor does not set tax rates calculate the amount of your taxes or collect taxes. The County sales tax rate is. This rate includes any state county city and local sales taxes.

The manufacturing exemption use tax rate is 000 CIDCommunity Improvement DistrictTDDTransportation Development DistrictTCEDTourism Community Enhancement DistrictPIDPort Improvement District. This is the total of state county and city sales tax rates. 2019 SalesUse Tax Rate Tables.

Louis which may refer to a local government division. Wayfair Inc affect Missouri. The December 2020 total local sales tax rate was also 9679.

The District of Columbias sales tax rate increased to 6 percent from 575 percent. Did South Dakota v. The item tax code listed under each rate column is the 4 digit suffix of the Jurisdiction Code for the type of tax rate displayed Jurisdiction Name.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. There is no applicable county tax. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Saint Louis MO Sales Tax Rate. Louis County The median property tax in St. In 2019 the tax rate was set at 816 and distributed as follows.

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. The Saint Louis sales tax rate is. Louis County Missouri Property Tax Go To Different County 223800 Avg.

The current total local sales tax rate in saint louis mo is 9679. No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent. The current total local sales tax rate in Saint Louis MO is 9679.

Louis county missouri tax rates 2020. Saint louis county mo sales tax rate. The Missouri sales tax rate is currently.

125 of home value Yearly median tax in St. What is the sales tax rate in saint louis missouri.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Missouri Car Sales Tax Calculator

Sales Tax Rates In Major Cities Tax Data Tax Foundation

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Sales Tax On Grocery Items Taxjar

Collector Of Revenue St Louis County Website

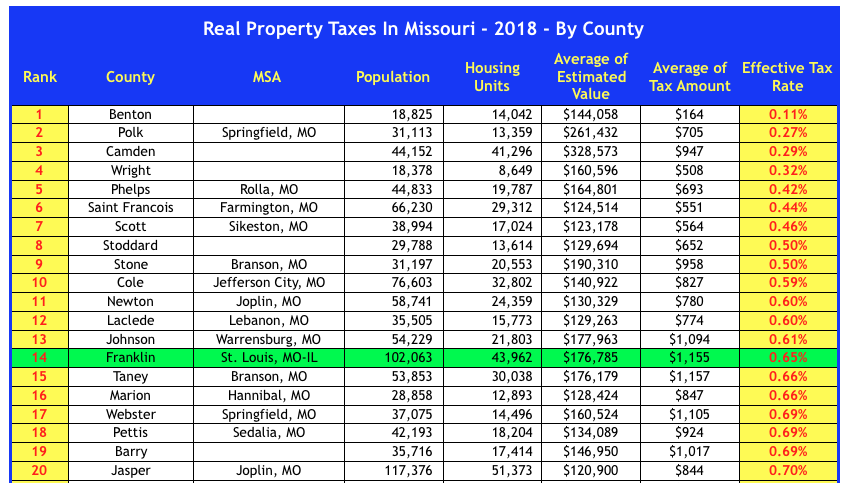

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News